In the rapidly evolving global market, Extrusion Aluminum Profiles have emerged as a pivotal component across various industries, driven by their versatility, lightweight nature, and excellent strength-to-weight ratio. According to a report by MarketsandMarkets, the global aluminum extrusion market is projected to reach approximately USD 70 billion by 2026, reflecting a compound annual growth rate (CAGR) of 5.5% from 2021. This growth underscores the increasing demand for high-quality and innovative aluminum profiles, particularly from China's manufacturing sector, which is renowned for its efficient production capabilities and cost competitiveness. As the tagline "中国制造,全球共享,品质值得信赖" suggests, Chinese manufacturing not only caters to local needs but also bridges global gaps, offering reliable and superior products to international buyers. This blog will explore alternative options for sourcing the best extrusion aluminum profiles in today’s globalized economy, highlighting key considerations for manufacturers and suppliers alike.

The aluminum extrusion market has seen remarkable growth in recent years, driven by increasing demand across various industries, including automotive, construction, and consumer goods. According to a report by Grand View Research, the global aluminum extrusion market is projected to reach USD 63.6 billion by 2025, growing at a compound annual growth rate (CAGR) of 6.0% through the forecast period. This expansion highlights the competitive landscape among global manufacturers, each striving to offer innovative solutions and superior quality profiles.

Key players in this sector, such as Hydro, Novelis, and Constellium, are leveraging advanced technologies to enhance their production processes. Hydro, for example, has reported increased efficiency through the implementation of automation and sustainable practices, which not only reduces waste but also meets the rising consumer demand for eco-friendly materials.

Additionally, a comparison of extrusion profiles reveals that manufacturers in Asia-Pacific, particularly those in China, are gaining significant market share due to lower labor costs and high production volumes, projected to contribute over 40% to the global market by 2026, as highlighted in a recent MarketWatch report. This regional dominance reflects the shifting dynamics of the aluminum extrusion landscape and indicates the importance of strategic partnerships and technological advancements for remaining competitive in the global marketplace.

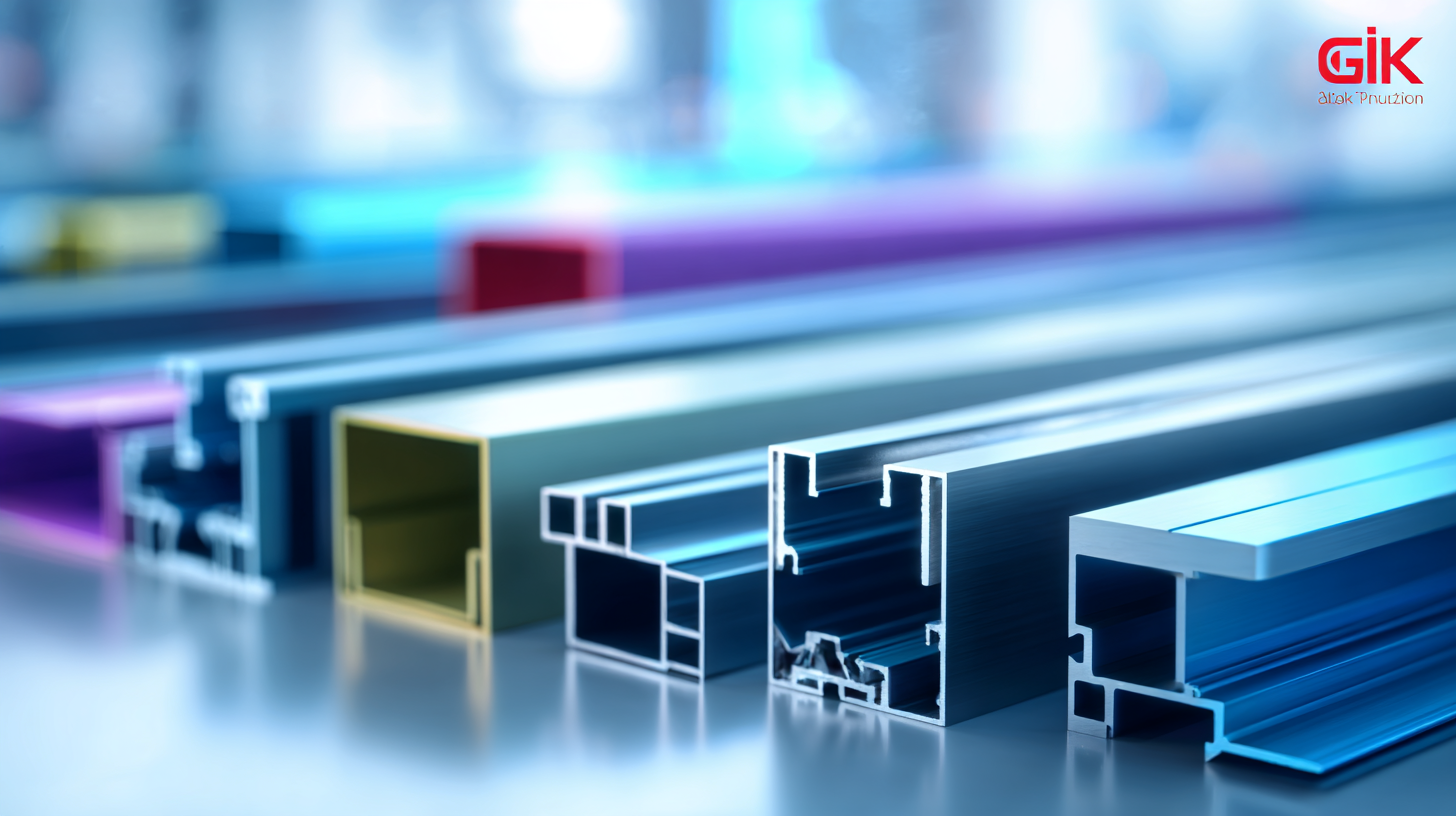

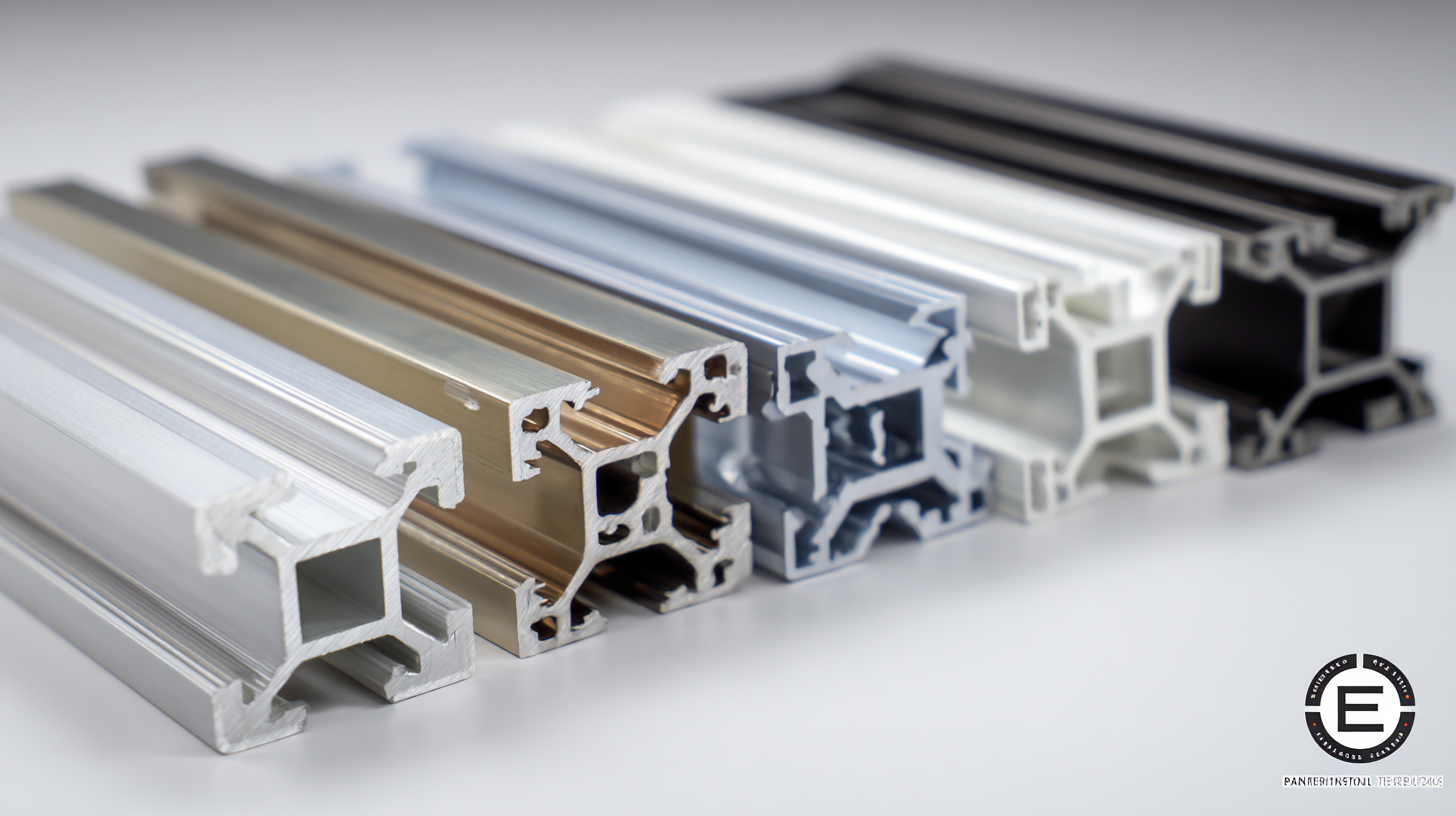

When exploring the best extrusion aluminum profiles in global markets, it’s crucial to focus on key metrics that evaluate their quality and performance. One of the primary metrics to consider is mechanical strength, which indicates how well the aluminum profile can withstand various loads without deforming. This strength is vital for applications ranging from structural components in buildings to precision parts in machinery. Additionally, understanding the alloy composition can provide insights into the properties and suitability of the aluminum for specific environments and applications.

Another important metric is surface finish. The quality of the surface treatment—whether anodized, painted, or mill finish—affects not only the aesthetic appeal of the profiles but also their durability and resistance to corrosion. A well-executed finish prolongs the lifespan of aluminum profiles and maintains their appearance over time, making it a critical aspect to evaluate. Finally, dimensional accuracy is essential, as extruded profiles must adhere to precise specifications to fit seamlessly into their intended applications. Evaluating these key metrics ensures that the chosen aluminum profiles deliver optimal performance in various industrial settings.

In today's global market, the demand for aluminum profiles continues to rise, driven by their versatility and durability across various applications. When evaluating cost-effectiveness, it's crucial to analyze the prices of aluminum profiles in different regions. Countries have varying production costs influenced by factors such as labor, raw materials, and manufacturing technologies. By diving into the nuances of pricing, businesses can make informed decisions that align with their budget and requirements.

Tips for maximizing cost-effectiveness include sourcing profiles from regions with lower production costs without compromising quality. Researching local suppliers can uncover competitive pricing and reduce shipping expenses. Additionally, consider bulk purchasing, as many manufacturers offer discounts for larger orders, providing further savings.

Another tip is to evaluate the long-term value of the aluminum profiles. Cheaper options might seem attractive initially, but assessing the durability and performance can save you money over time. Investing in high-quality profiles can prevent frequent replacements and maintenance, ensuring a smart allocation of resources in the long run.

The global market for green aluminum is experiencing significant growth, driven by increasing demand for sustainable practices in aluminum extrusion. According to a study published by Custom Market Insights, it is projected that the global green aluminum market size will surpass USD 220 billion in the coming years. This growth highlights the industry's shift towards adopting more eco-friendly production methods, which not only lower carbon emissions but also optimize resource efficiency.

One key aspect of this competitive landscape is the emphasis on sustainable sourcing and innovative processing techniques. Companies are investing heavily in technologies that enhance recyclability and reduce energy consumption during extrusion. The report indicates that sustainable practices not only meet regulatory requirements but also appeal to environmentally conscious consumers, thereby creating a strategic advantage in the marketplace. As brands strive to differentiate themselves, the integration of sustainability into their core operations is becoming essential for capturing market share in a rapidly evolving global economy.

| Region | Sustainability Practices | Market Share (%) | Main Materials Used | Energy Consumption (kWh/kg) |

|---|---|---|---|---|

| North America | Recycling, Renewable Energy | 30 | Alloy 6061, Alloy 6063 | 12 |

| Europe | Closed-loop recycling, Eco-design | 27 | Alloy 6082, Alloy 6005 | 11 |

| Asia-Pacific | Energy-efficient practices, Waste reduction | 35 | Alloy 7075, Alloy 5005 | 14 |

| Latin America | Sustainable sourcing, Community engagement | 5 | Alloy 2024, Alloy 6060 | 13 |

| Middle East | Water conservation, Efficient energy use | 3 | Alloy 6001, Alloy 7010 | 15 |

The extrusion aluminum profiles market is significantly shaped by regional trends, highlighting variations in demand and manufacturing processes across the globe. In North America, for example, there is a growing emphasis on sustainable building practices, leading to an increased preference for lightweight and recyclable aluminum profiles. This shift is spurred by regulations promoting energy efficiency and minimal environmental impact, positioning extrusion aluminum as a leading material for construction and transportation sectors.

In Asia-Pacific, rapid urbanization and industrialization are driving the demand for extrusion aluminum profiles. Countries like China and India are investing heavily in infrastructure development, which has led to heightened usage in architectural and automotive applications. Additionally, advancements in manufacturing technologies in this region are enabling the production of high-quality aluminum profiles at competitive prices, further expanding their market reach. Understanding these regional trends is crucial for manufacturers and suppliers aiming to tailor their strategies and product offerings effectively to meet diverse market needs.